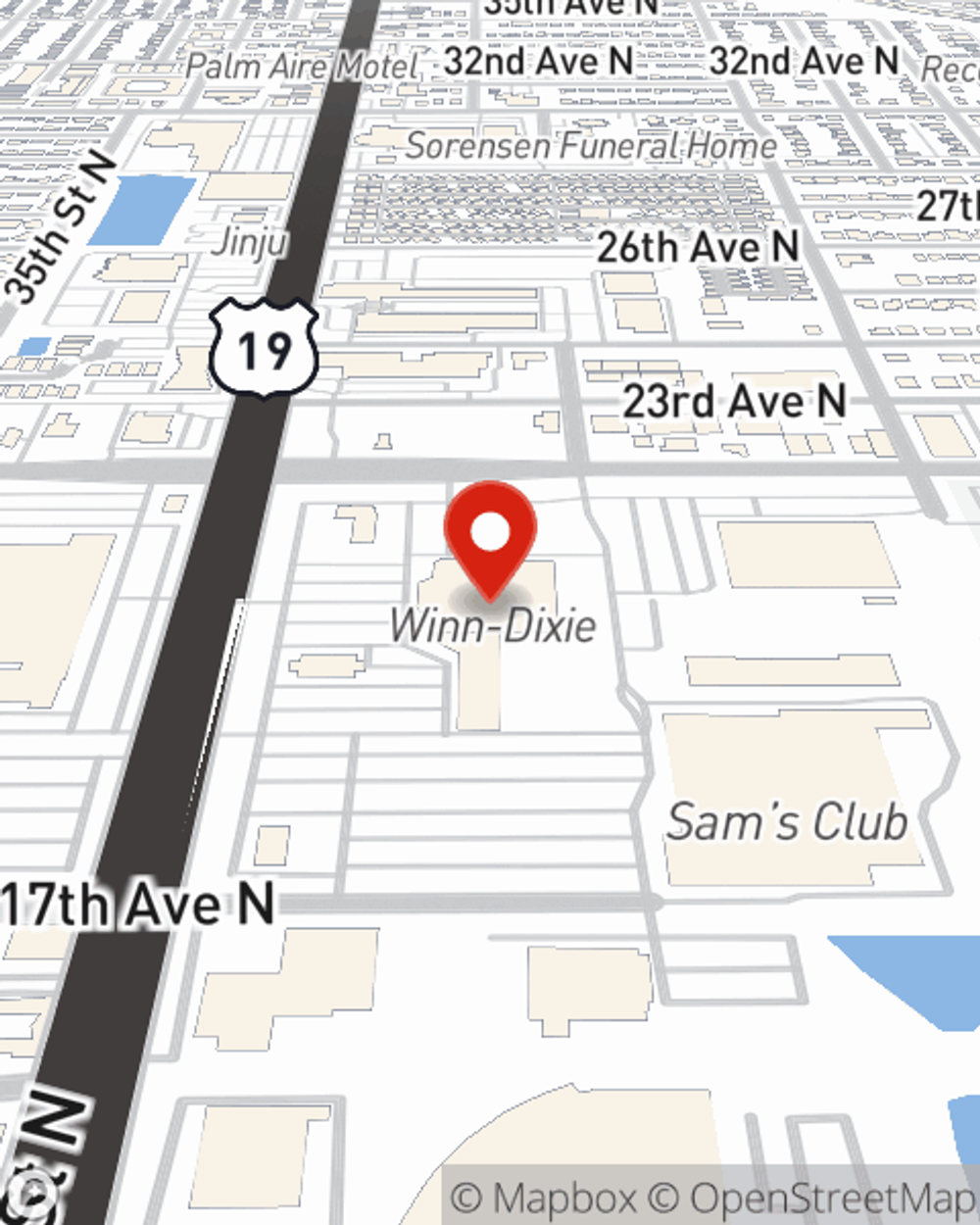

Insurance in and around St. Pete

Multiple ways to help keep more of your hard-earned dollars

Protect what matters most

Would you like to create a personalized quote?

Be Ready For The Unexpected With Your Own Personal Price Plan®

Your loved ones and your things are some of what's most important to you. It's natural to want to protect them. That's why State Farm offers great insurance where you can construct a Personalized Price Plan to help fit your needs.

Multiple ways to help keep more of your hard-earned dollars

Protect what matters most

Insurance Products To Meet Your Ever Changing Needs

But your automobile is just one of the many insurance products where State Farm and Luis Macias can help. House, condo, or apartment, if it’s your home, it deserves State Farm protection. And for the unexpected. Securing your family’s financial future can be a major concern. Let us ease that burden. With a range of products, cost structures, and unmatched financial strength, State Farm Life Insurance is a smart choice and a great value.

Simple Insights®

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Luis Macias

State Farm® Insurance AgentSimple Insights®

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.